37+ tax deductions for mortgage interest

Web When filing your income taxes you must choose either the standard deduction or itemized deductions not both. Learn More at AARP.

New Homeowners Pay Considerably More In Taxes Than Longtime Homeowners Voice Of San Diego

For married taxpayers filing separate returns the cap.

. Married filing jointly or qualifying widow er. Web Homeowners can use several tax credits and deductions including the mortgage interest deduction and the SALT deduction to reduce their tax bills. Web Topic No.

But for loans taken out from. Web If you are married and filing separately from your spouse you can deduct interest payments on mortgage debt up to 375000 each tax year For mortgages taken. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

So if you were dutifully. Web For example if you pay 3000 in points to obtain a lower interest rate on your mortgage you can increase your mortgage interest deduction by 3000 in the tax. Taxes Can Be Complex.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Single or married filing separately 12550. Web Mortgage interest.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Homeowners who bought houses before. Web IRS Publication 936.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Interest is an amount you pay for the use of borrowed money. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard.

There is also a known issue some users are experiencing with the Mortgage Interest. Web A 1000 tax credit would reduce their total tax bill to 9000. Web 84037 November 53197 83893 December 53341.

Some interest can be claimed as a deduction or as a credit. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web For 2021 tax returns the government has raised the standard deduction to.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Web Some TurboTax customers may be experiencing an issue because TurboTax isnt allowing qualified customers to deduct the full amount of their home mortgage interest.

This deduction is capped at 10000 Zimmelman says. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

Taxes Can Be Complex. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Here are the standard deductions for the 2022 tax year.

Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more likely. A 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected. Web Enter your address and answer a few questions to get started.

Web Your mortgage interest will show on line 8b of your schedule A. For tax year 2022 those amounts are rising to. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. With the home interest mortgage deduction HIMD homeowners have the opportunity to deduct.

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

What Expenses Can Be Deducted From Capital Gains Tax

Salary Certificate Templates 37 Word Excel Formats Samples Forms Certificate Templates Certificate Format Salary

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

What Expenses Can Be Deducted From Capital Gains Tax

37 Delivery Note Templates Pdf Docs Word

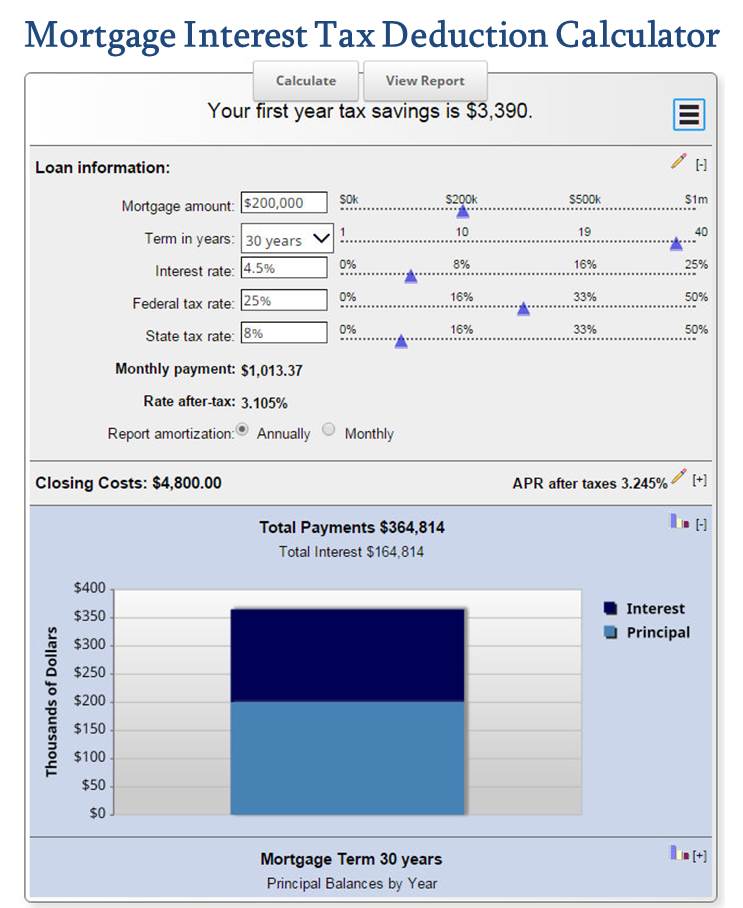

Mortgage Tax Deduction Calculator Freeandclear

Home Mortgage Interest Deduction Calculator

The Home Mortgage Interest Deduction Lendingtree

Keep The Mortgage For The Home Mortgage Interest Deduction

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

10 Steps Toward Home Ownership Mortgage 1 Inc