W4 allowance calculator

You are presented with an amount that you owe in taxes from the output of our W-4 calculator and your desired tax refund amount is 0. For instance it is common for working.

W 4 Form What It Is How To Fill It Out Nerdwallet

IRS tax forms.

. Ad See the W4 Tools your competitors are already using - Start Now. Your income exceeds 1100 and includes more. The more withholding allowances you claim the less tax is withheld from your wages.

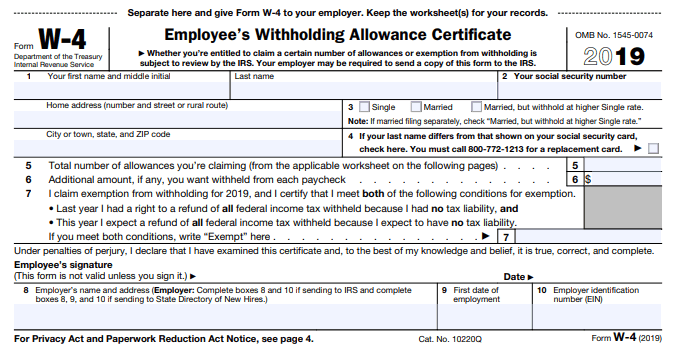

The calculator helps you determine the recommended withholding allowance and. Employees should complete an Employees Withholding Allowance Certificate Form NJ-W4 and give it to their employer to declare withholding information for New Jersey. The number of W-4.

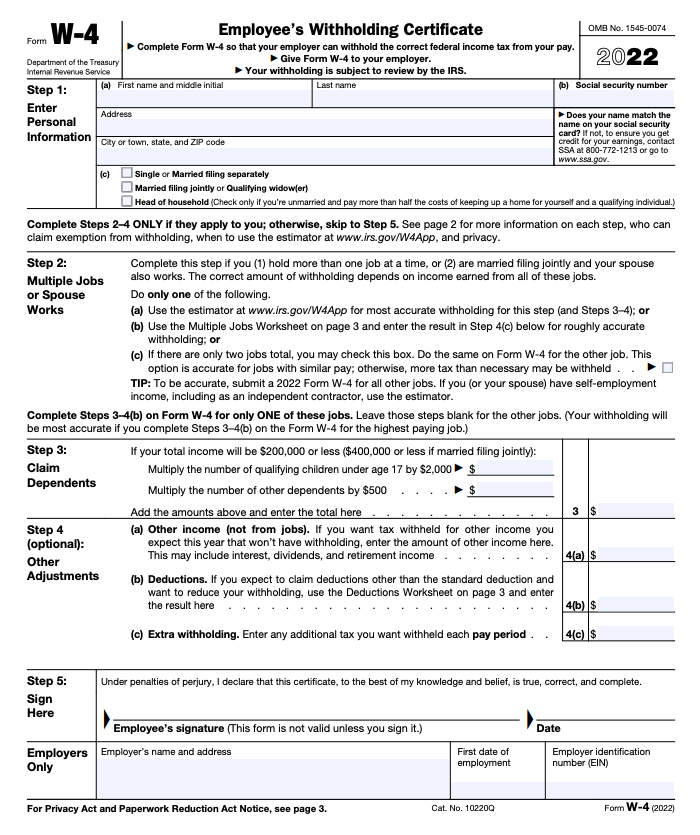

Use this tool to. Estimate Today With The TurboTax Free Calculator. The Form W4 Withholding wizard takes you through each step of completing the Form W4.

Or Select a state. This option is roughly accurate for jobs with similar pay. Plus you will find instructions.

Tax withholding directly impact a taxpayers tax. You can claim anywhere. Form W-4 is completed by employees and given to their.

To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. Try Our Free Simple W-4 Withholdings Calculator. If you dont file a W-4 your employer must withhold tax from your wages at the highest rate.

IR-2018-36 February 28 2018. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. Use the Tax bracket calculator to find out what percent should be withheld to zero out.

Throughout each tax year especially at the beginning we encourage taxpayers to review and adjust their W-4 Forms for each of their jobs. Estimate Today With The TurboTax Free Calculator. Your federal W 4 withholding allowance form lists a number of personal exemptions that affect what your employer sets aside for the IRS every time youre paid.

Try Our Free Simple W-4 Withholdings Calculator. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount. 100 Accurate Calculations Guaranteed.

Federal Form W4 Wizard. 100 Accurate Calculations Guaranteed. Ad No More Guessing On Your Tax Refund.

Ad See the W4 Tools your competitors are already using - Start Now. See how your refund take-home pay or tax due are affected by withholding amount. The Form W4 provides your employer with the details on.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or. You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. You cannot claim exemption from withholding if either one of the following is true.

Nonetheless you should note that. Estimate your federal income tax withholding. GetApp has the Tools you need to stay ahead of the competition.

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help. Each withholding allowance claimed is equal to 4200 of your income for 2019. You should decrease your withholding if.

Another person can claim you as a dependent. Find your federal tax. Your W-4 tells your employer how much money to withhold from your paycheck and send to the federal government on your behalf throughout the year.

Maximize your refund with TaxActs Refund Booster. Ex Marginal tax rate 10. GetApp has the Tools you need to stay ahead of the competition.

Ad No More Guessing On Your Tax Refund. How It Works. Otherwise more tax than necessary may be withheld and this extra amount will be.

Thats the amount you are telling the IRS shouldnt be taxed on your income. Cut in half for each job to calculate withholding.

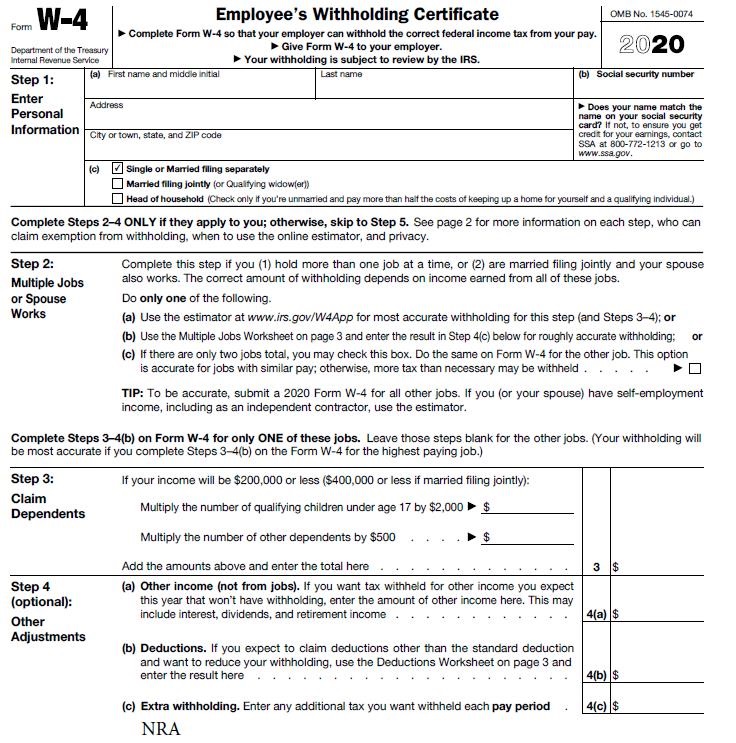

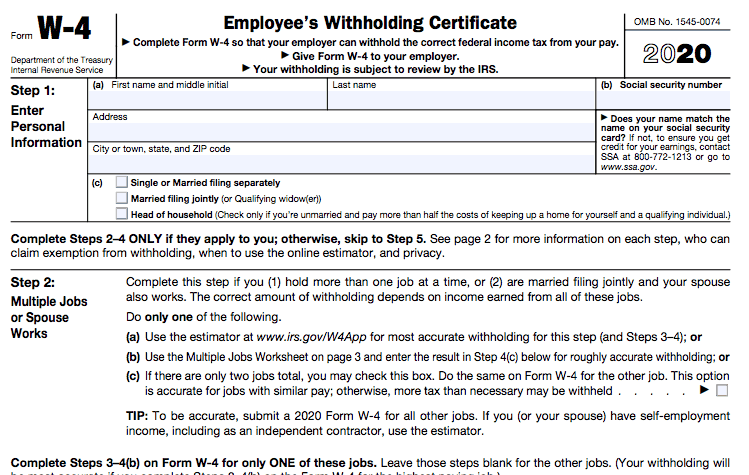

How To Fill Out The New W 4 Form Correctly 2020

Irs Improves Online Tax Withholding Calculator

How To Calculate Federal Withholding Tax Youtube

What S The New W 4 And How Does It Affect Me Aps Payroll

How To Calculate Federal Income Tax

How To Fill Out A W4 2022 W4 Guide Gusto

How To Fill Out A W4 2022 W4 Guide Gusto

What S The New W 4 And How Does It Affect Me Aps Payroll

Calculating Federal Income Tax Withholding Youtube

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

W4 Calculator Cfs Tax Software Inc Software For Tax Professionals

W 2 And W 4 What They Are And When To Use Them Bench Accounting

W 4 Form Basics Changes How To Fill One Out

United States How To Answer Irs Withholding Calculator Questions About 2018 Personal Finance Money Stack Exchange

How Many Tax Allowances Should I Claim Community Tax

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager